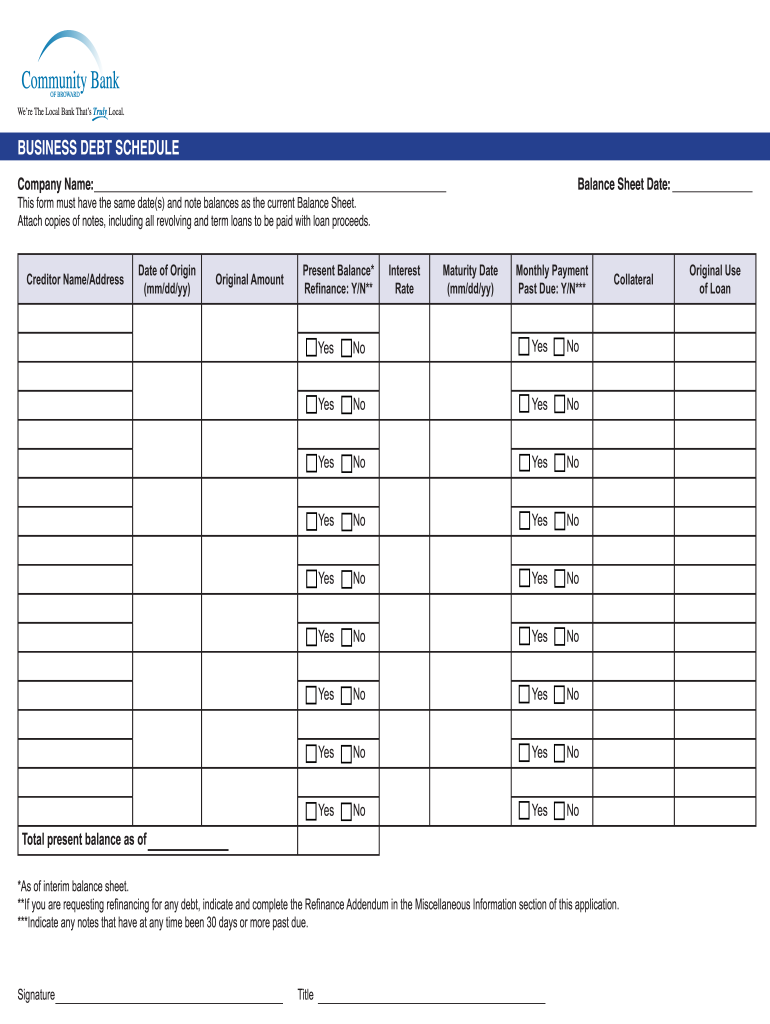

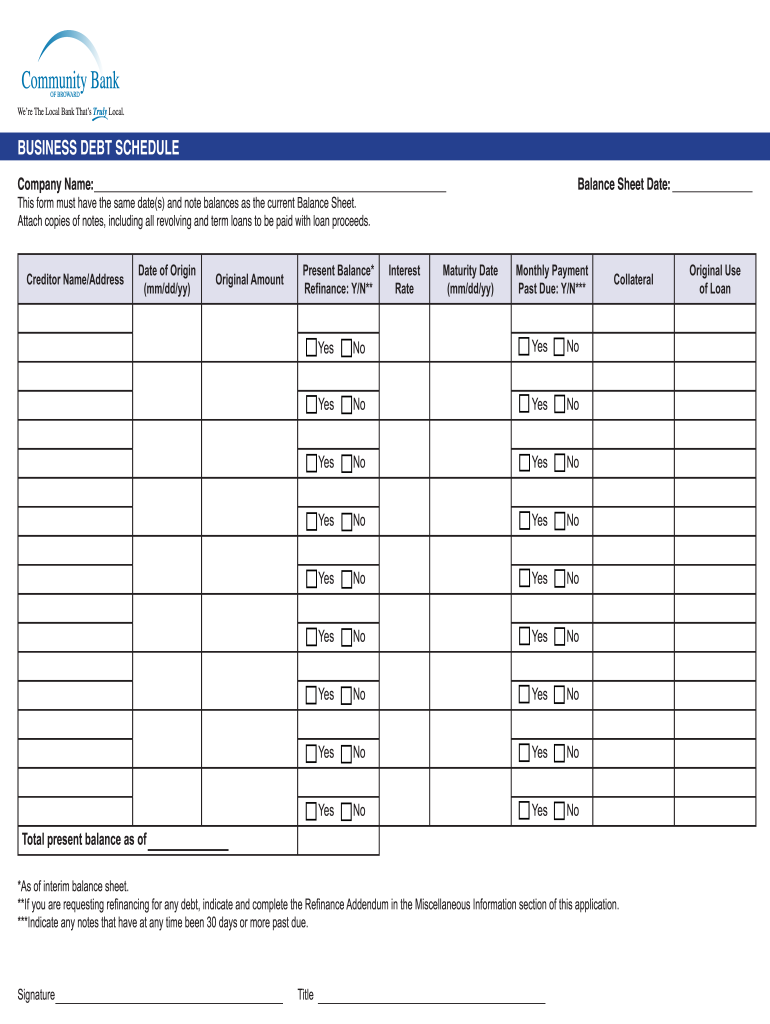

FL Community Bank of Broward Business Debt Schedule 2010-2024 free printable template

Get, Create, Make and Sign

How to edit debt schedule template excel online

How to fill out debt schedule template excel

How to fill out debt schedule template excel?

Who needs debt schedule template excel?

Video instructions and help with filling out and completing debt schedule template excel

Instructions and Help about personal debt schedule template form

In this section of the financial analysis let's look at debt and interest payments, so we're going to set this up here, and before I start filling in the area down below I just want to quickly freeze the panes here if I click on view and I click on freeze panes it freezes on the left side and the top side of wherever my cursor is so the reason I've done that is while I still scroll down here I still want to see what year were in, so I've frozen the panes and what I'm going to do down here is created a new section called debt assumptions and the first thing I'm going to do is the loan amount and let's say it's going to be 5 million just make sure that's formatted as a number, so I'm going to type five million then we're going to have the term in this case let's say it's a five-year loan, and then we have the rate let's say it's four and a half percent, and then I'm going to select these numbers, and I'm going to change the font color to be the standard blue that I'm using, and then I'm going to make a little schedule down here where I've got the opening balance of debt the total payment the interest payment the principal and the closing balance, so we're going to learn a few different formulas here so the first thing that I want to do is just link the opening balance to be the loan amount five million dollars then we're going to use excels PMT function which calculates the total payment so what I need to do here is link to the rate which I lock with f4 comma the number of periods which is five, and I had lock with f4 comma the present value of the loan the present value is the amount five million, and then I close bracket, so that's the payment is the combination of interest and principle let's calculate the AI PMT interest payment which as you can see when it's prompting me for here requires the rate which I lock with have for period is the current period we're in, so I'm actually going to link that to a cell right above there's nothing in that cell yet, but we're gonna fill in the period number just right after this comma and as the number of periods the term f4 and then the present value 5000000 f4 close bracket now it's not working because I don't have a 1 in there yet one being the first period I'm going to make that blue, and then I'm going to set this equal to prior period plus 1, and I can fill that right, so now I've got the opening balance less the total payment I've broken out the interest payment once I know the interest payment I can take the difference between the total payment and interest and that has to be the principal because those are the only two types of payments finally I can calculate the closing balance which is the opening balance plus any principal repayment that's made next periods opening balance is equal to last periods closing pounds the rest of the formulas can simply be copied over to the right and once I have all these in place and I select these cells out to five years if I press CTRL R I should hit zero at the...

Fill debt roll forward schedule template : Try Risk Free

People Also Ask about debt schedule template excel

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your debt schedule template excel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.