FL Community Bank of Broward Business Debt Schedule 2010-2026 free printable template

Show details

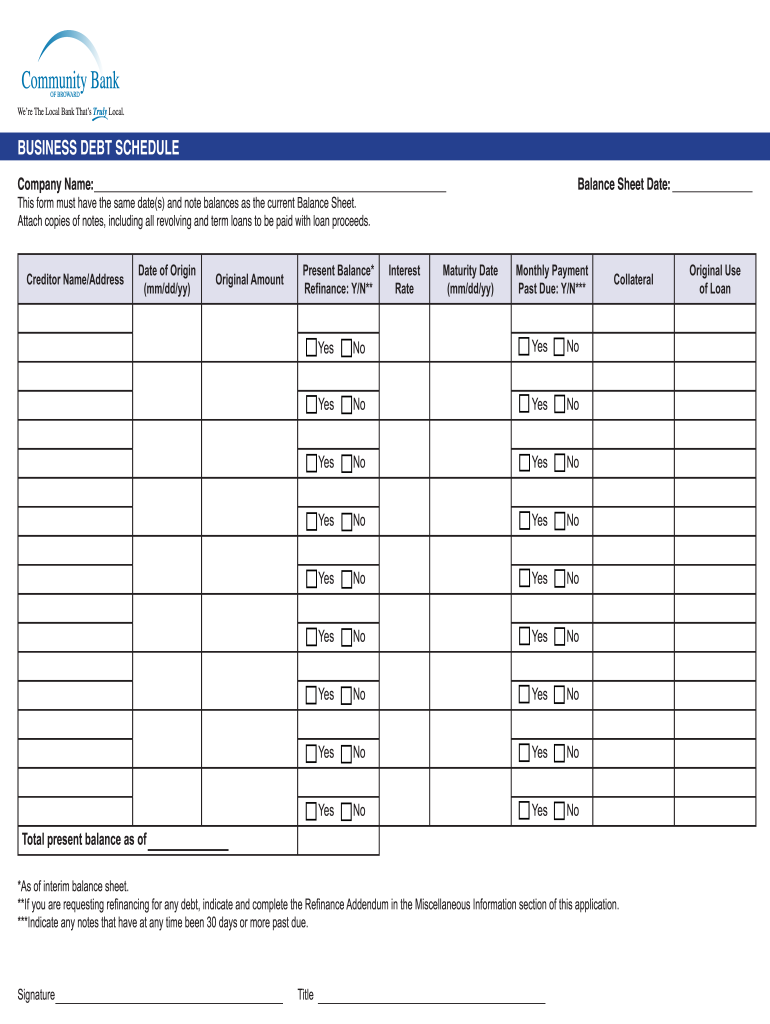

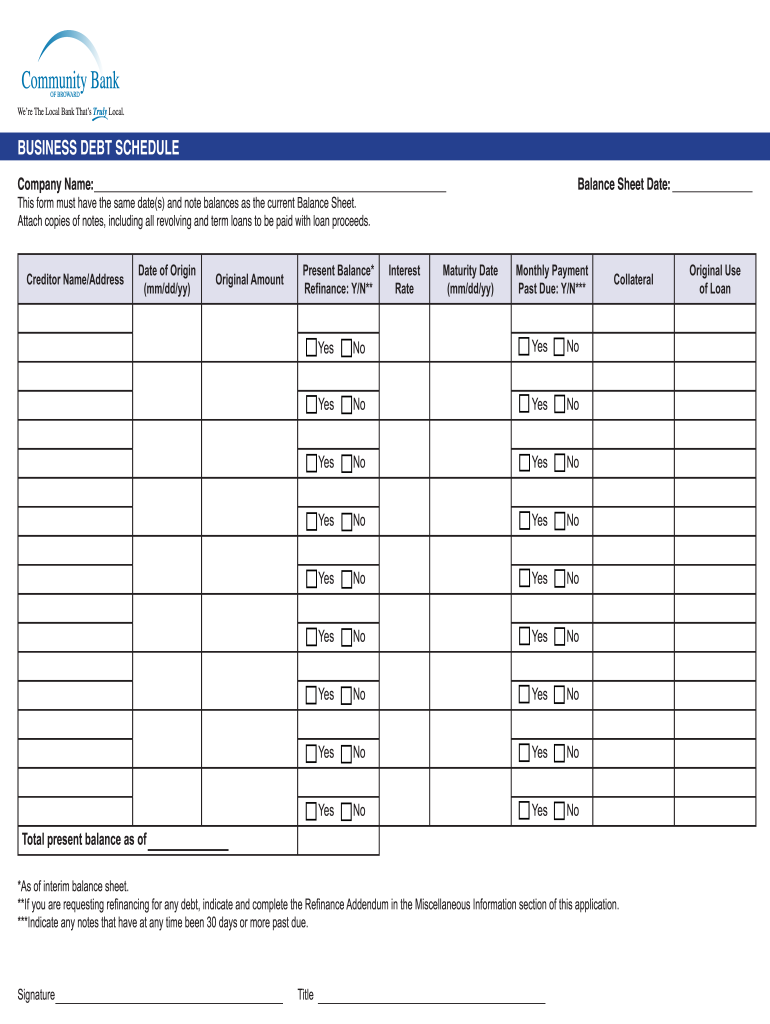

BUSINESS DEBT SCHEDULE Company Name: Balance Sheet Date: This form must have the same date(s) and note balances as the current Balance Sheet. Attach copies of notes, including all revolving and term

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pdffiller form

Edit your debt schedule template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt rollforward form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit debt schedule example online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business debt schedule template form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business debt schedule form

How to fill out FL Community Bank of Broward Business Debt Schedule

01

Gather all relevant financial documents related to your business debts.

02

Start with the business name and tax ID number at the top of the form.

03

List each debt separately, including details such as the creditor's name, the original amount of the debt, and the current outstanding balance.

04

Include the interest rate, monthly payment amount, and the remaining term (in months) for each debt.

05

If applicable, indicate whether the debt is secured or unsecured.

06

Review the completed form for accuracy and completeness before submission.

Who needs FL Community Bank of Broward Business Debt Schedule?

01

Business owners applying for a loan from FL Community Bank of Broward.

02

Businesses seeking to demonstrate financial obligations to better understand their debt management.

03

Financial institutions requiring a comprehensive view of a business's debt for evaluation purposes.

Fill

simple debt schedule

: Try Risk Free

People Also Ask about simple debt schedule template excel

What is an annual debt schedule?

What is a Debt Schedule? A debt schedule lays out all of the debt a business has in a schedule based on its maturity. It is typically used by businesses to construct a cash flow analysis.

Are credit cards included in a debt schedule?

Berman said a business owner's personal debt schedule should include all personal debts, such as a mortgage, credit cards, car loans, and student loans.

What is debt schedule in an LBO?

What is “Debt Schedule?” The term debt schedule is in the context of an LBO transaction. It refers to the calculation of the annual principal and interest payments due each year, following a LBO transaction. In an LBO transaction, multiple debt instruments are involved.

How do you calculate debt schedule?

Debt Schedule Build Calculating the total debt balance is straightforward, as you just add up the ending balances of each tranche for each period. Interest expense is calculated using the average debt balances – i.e. the average between the beginning and ending balance.

How do I create a debt schedule?

When you begin to make a debt schedule, list out all the relevant details of the debt, including: Creditor or lender name. Origination date of the debt. Original debt amount. Current balance. Interest rate. Monthly payment. Security or collateral pledged. Maturity date.

How do you forecast debt schedule?

Forecasting debt requires forecasting both short-term and long-term debt, as well as the associated interest costs. Once we've completed the financing forecast, we can complete the cash section, thereby completing the balance sheet. In short, cash is determined simply as the balancing figure in the balance sheet.

Is a debt schedule a balance sheet?

Unlike the balance sheet, which generally only shows loan balance (and nothing for leases), a debt schedule includes some or all of the following: Creditor/lender. Original amount of debt. Current balance.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my debt rollforward template directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign business debt schedule example and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete debt rollforward schedule online?

pdfFiller has made it easy to fill out and sign business debt schedule template excel. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I fill out debt chart template on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your sample debt schedule. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is FL Community Bank of Broward Business Debt Schedule?

The FL Community Bank of Broward Business Debt Schedule is a financial document that outlines all existing debts of a business, providing a comprehensive overview of its liabilities.

Who is required to file FL Community Bank of Broward Business Debt Schedule?

Businesses seeking loans or financial services from FL Community Bank of Broward are typically required to file the Business Debt Schedule to assess their current financial obligations.

How to fill out FL Community Bank of Broward Business Debt Schedule?

To fill out the FL Community Bank of Broward Business Debt Schedule, businesses should list each debt, including details such as creditor name, amount owed, payment terms, and due dates, ensuring all information is accurate and up-to-date.

What is the purpose of FL Community Bank of Broward Business Debt Schedule?

The purpose of the FL Community Bank of Broward Business Debt Schedule is to provide the bank with a clear picture of a business's debt obligations, aiding in decision-making regarding creditworthiness and loan approval.

What information must be reported on FL Community Bank of Broward Business Debt Schedule?

The Business Debt Schedule must report information such as the type of debt, total amount owed, monthly payments, interest rates, due dates, and any collateral associated with the debts.

Fill out your FL Community Bank of Broward Business Debt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is A Business Debt Schedule is not the form you're looking for?Search for another form here.

Keywords relevant to biws debt schedule

Related to debt spreadsheet template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.